The Future of Finance: Decentralized Stablecoins and Their Impact

As the world becomes increasingly digital, the financial sector is undergoing a significant transformation. With advances in technology and growing concerns about market volatility and instability, new players are emerging to disrupt traditional financial systems. One area that shows great promise is decentralized stablecoins, cryptocurrencies designed to be stable, secure, and pegged to a fiat currency.

What are Stablecoins?

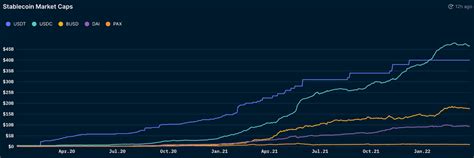

Stablecoins are digital currencies backed by traditional assets such as gold or other commodities. They aim to provide a hedge against inflation, market volatility, and economic uncertainty. The most well-known stablecoin is USDT (Tether), which has been widely adopted for trading on cryptocurrency exchanges.

Key Features of Decentralized Stablecoins

Decentralized stablecoins offer several advantages over traditional fiat currencies:

- Security

: Stablecoins are protected by complex algorithms that ensure their value remains stable, even if one of the parties experiences financial difficulty.

- Transparency: All transactions are recorded on public ledgers, making it easier to track and verify the movement of funds.

- Liquidity: Decentralized stablecoins can be easily bought or sold on cryptocurrency exchanges, providing quick access to liquidity.

- Decentralization: Stablecoins operate independently of traditional financial systems, reducing dependence on intermediaries.

Impact on Traditional Finance

The introduction of decentralized stablecoins will likely have a significant impact on traditional finance:

- Increased Adoption: As people become more comfortable with digital currencies and stablecoin-based solutions, adoption rates are likely to increase.

- Reduced Risk: Decentralized stablecoins offer a hedge against market fluctuations, making them an attractive option for investors seeking diversification.

- New Business Models: Stablecoins enable new business models, such as decentralized finance (DeFi) platforms, which are disrupting traditional lending and borrowing systems.

Examples of Decentralized Stablecoins

Several notable stablecoin projects have been launched in recent years:

- USDT (Tether): Pegged to the U.S. dollar, USDT is one of the most widely recognized stablecoins.

- USD Coin (USDC): Another well-known stablecoin, USD Coin is backed by a reserve of US dollars.

- DAI (DeFi Stablecoin): A decentralized stablecoin platform that enables lending and borrowing in DeFi protocols.

Challenges and Concerns

While decentralized stablecoins offer many benefits, there are also challenges and concerns to consider:

- Regulatory Uncertainty: The regulatory landscape for stablecoins is still evolving, creating uncertainty for market participants.

- Security Risks: As with any digital currency, there are security risks to stablecoins, including hacking and phishing attacks.

- Scalability Issues: Decentralized stablecoins often face scalability challenges, which can limit their adoption.

Conclusion

The future of finance is rapidly evolving, with decentralized stablecoins poised to play a significant role in disrupting traditional financial systems. As regulatory uncertainty diminishes and security concerns are addressed, the benefits of these innovative assets will become more apparent. While there are challenges ahead, the potential for decentralized stablecoins to positively impact the global economy makes it an exciting area for exploration.

Recommendations

- Stay informed: Constantly monitor developments in the industry and stay up to date with regulatory updates.

- Diversify your portfolio: Consider diversifying your portfolio by allocating a portion of your assets to stablecoins and decentralized finance platforms.

3.

دیدگاهها